Strong referral programs work across three areas: Acquisition by offering different rewards based on how long customers have been with you and catching people when they’re most engaged, Retention by watching for customers who stop referring as a warning sign they might cancel, and LTV growth by recognizing that customers who refer early are your best candidates for upgrades. The smartest move is treating your referral program as an early warning system for how well your product is working, not just as another way to get customers. Watch how quickly referred customers pay back their rewards (shoot for 3-4 months), what percentage of new customers refer within 90 days, and how many customers came from someone who was also referred (aim for 30-40%).

1. Acquisition: Using Referrals to Drive Quality Subscribers

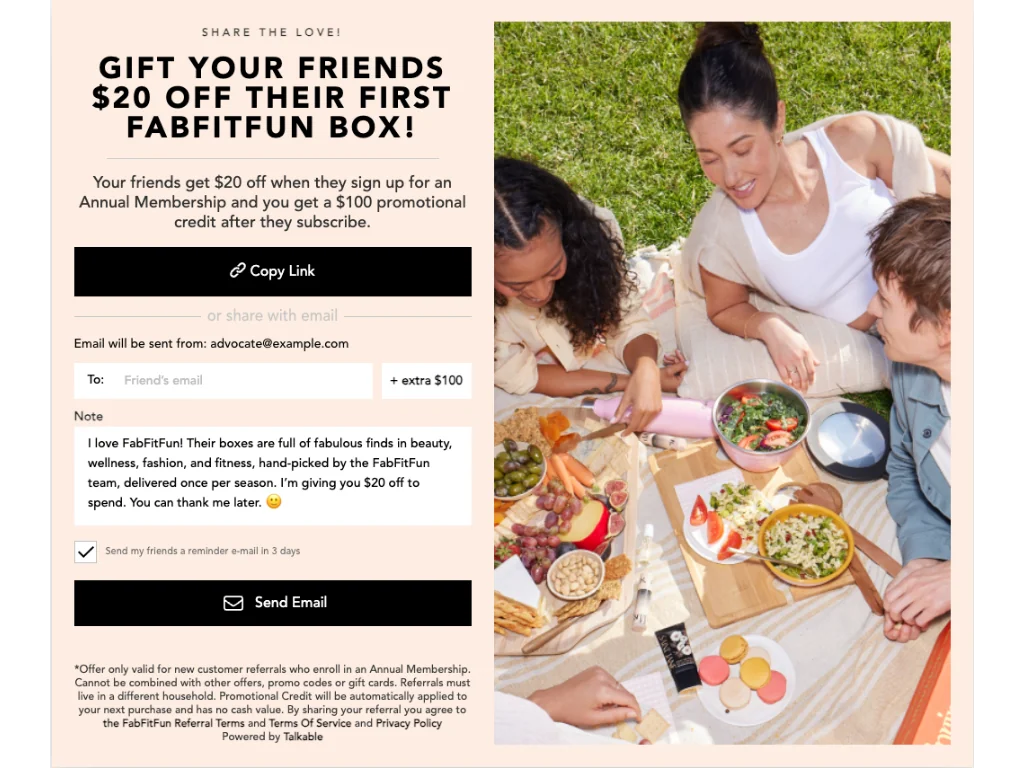

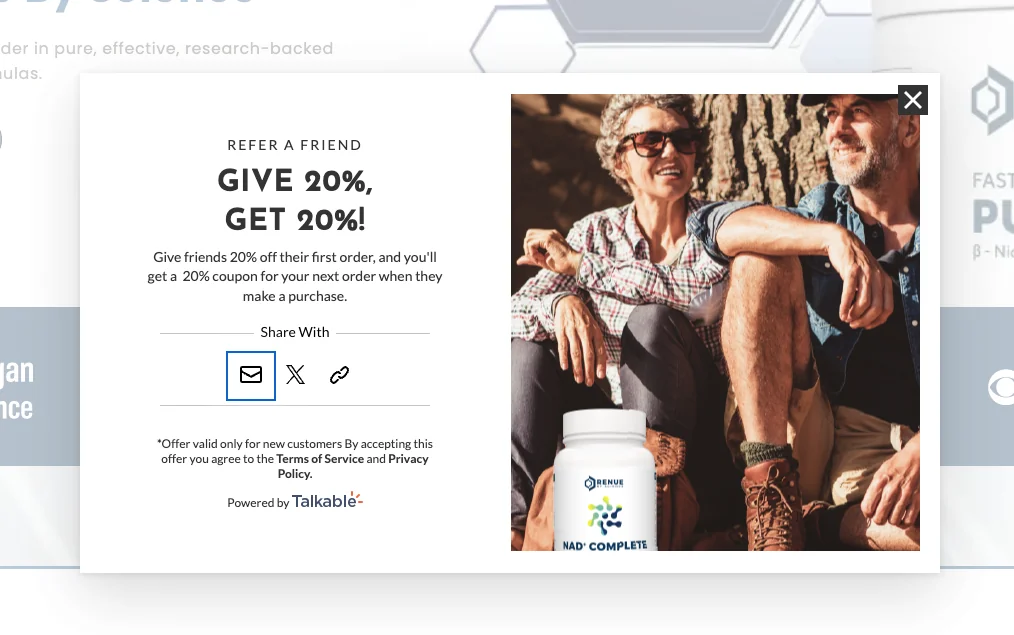

Price your rewards asymmetrically for different customer cohorts. Instead of a universal “$20 for both,” test offering higher rewards to customers with longer tenure or higher AOV. Your month-12 customer costs nothing to retain but could unlock three new subscribers, making a $40 reward economically sound. Meanwhile, month-1 customers need lower rewards since you’re still recouping their acquisition cost.

Leverage “skip” moments as high-intent referral triggers. When customers skip a delivery, they’re actively engaging with your platform but signaling reduced commitment. A prompt like “Skipping this month? Gift this delivery to a friend instead and we’ll give you both $25 off next time” converts the skip into an acquisition opportunity while keeping the skipper engaged.

Track referral channel attribution separately. Instagram Story shares convert at 3-4x the rate of email forwards for visual products, but email drives higher average order values. Build channel-specific creative assets and measure which channels your best customers use to refer. Double down on high-performing channels with custom landing pages and optimized copy.

Test delayed gratification structures. Counter-intuitively, “Refer 3 friends this quarter and unlock a $100 credit” can outperform “Get $30 per friend” by creating a goal-oriented challenge. The larger reward feels more significant and drives multiple referrals from the same customer rather than one-and-done behavior.

2. Retention: Making Referral Programs Sticky

Use referral activity as a leading churn indicator. Customers who refer in months 2-4 have 40-60% better retention than non-referrers, but the causation runs both ways. When previously active referrers go silent, flag them for proactive outreach before they churn. Build a monthly report of “referrers who haven’t shared in 90 days” and treat it like an at-risk segment.

Implement social proof loops between referrer and referee. Send the referrer updates when their friend hits milestones: “Sarah just got her 3rd delivery thanks to you!” This creates a psychological investment in their friend’s success and keeps your brand top-of-mind. The referrer becomes an informal customer success manager, often checking in with friends organically.

Structure rewards to span billing cycles. If your churn risk spikes at month 4, design rewards that pay out over months 3-5: “$10 credit each month your referral stays active, up to 6 months.” This keeps referrers engaged through their own danger zone while you’re building the referred customer’s habit.

Create negative churn through referral credits. Customers with $30+ in unused referral credits are 70% less likely to cancel because they perceive sunk value. However, don’t let credits expire or they lose motivational power. Instead, cap total earnings if needed but keep credits perpetual.

3. Growing LTV: Maximizing Long-Term Value Through Referrals

Referral propensity predicts upgrade potential. Customers who refer within their first 60 days are 2-3x more likely to upgrade to annual plans or premium tiers. Use referral behavior as a qualification signal for your upsell campaigns. Prioritize these customers for white-glove onboarding to premium features, knowing their advocacy signals both satisfaction and higher willingness to invest.

Engineer exclusivity into your ambassador tier. Cap your ambassador program at 100-200 people maximum, even as you scale. The exclusivity itself becomes a status symbol that drives both referrals (to gain entry) and retention (fear of losing status). Publish ambassador benefits publicly but keep the list private and invite-only based on referral volume and tenure.

Mine household clustering for multi-subscription opportunities. When you see referral patterns within the same household (different email, same address), you’re looking at gift-giving behavior or household sharing. Build targeted campaigns for these clusters: “Send a 3-month gift subscription to your referrals for 40% off.” This converts casual referrals into multi-subscription households with 3-5x the LTV.

Use referral credit burn rate to identify expansion candidates. Customers who earn credits but don’t redeem them for 6+ months are either forgetting about them or don’t need discounts. These are your highest-margin customers. Offer them the option to “donate” unused credits to a friend’s first order or convert credits to premium add-ons instead of discounts, moving them upmarket.

Track referral half-life by acquisition channel. Customers acquired through Instagram ads might refer within 30 days while Google Search customers take 90 days. Plot your cohorts’ referral curves and adjust your referral prompts by original acquisition source. Early-referring channels should get immediate referral CTAs; slow-burn channels should get delayed triggers after they’ve built more product attachment.

Advanced Metrics Worth Tracking

Referral payback period. How long does it take for a referred customer’s gross margin to cover both the referral reward and their own CAC? Top-performing programs hit payback in 3-4 months. If you’re taking 8+ months, your rewards are too rich or you’re attracting low-quality referrals.

Referral momentum score. Track the percentage of new customers who refer within their first 90 days, broken out by cohort month. A declining score suggests product-market fit erosion or weakening onboarding. This metric often predicts broader retention issues 2-3 months before they show up in churn data.

Multi-generational referral depth. What percentage of your customer base came from 2nd or 3rd-generation referrals? If this number is below 15%, you have viral coefficient issues. Strong programs see 30-40% of customers trace back multiple generations, indicating true word-of-mouth loops rather than one-off advocacy.

Credit liability vs. redemption velocity. Total outstanding referral credits divided by monthly redemption rate tells you how many months of liability you’re carrying. Above 8 months suggests customers don’t value the credits (wrong reward type) or have friction redeeming them. Below 2 months means you’re not generating enough referral volume.

Referral attribution window decay. Measure conversion rates by time elapsed between referral link creation and signup (0-24 hours, 1-7 days, 8-30 days, 30+ days). If your 30+ day conversions are above 20%, you have strong brand recall but should test longer attribution windows. If below 5%, your referral value prop isn’t memorable enough to survive consideration cycles.

Strategic Integration

The businesses that extract the most value from referral programs treat them as a diagnostic tool for product-market fit, not just an acquisition channel. When referral velocity suddenly drops or conversion rates decline, it’s often the first signal that something has changed in your product, positioning, or target market. Use referral health as a leading indicator for your entire growth strategy, and structure your program to reinforce behaviors that drive both customer and business value over time.